Trading Places

July 09, 2024

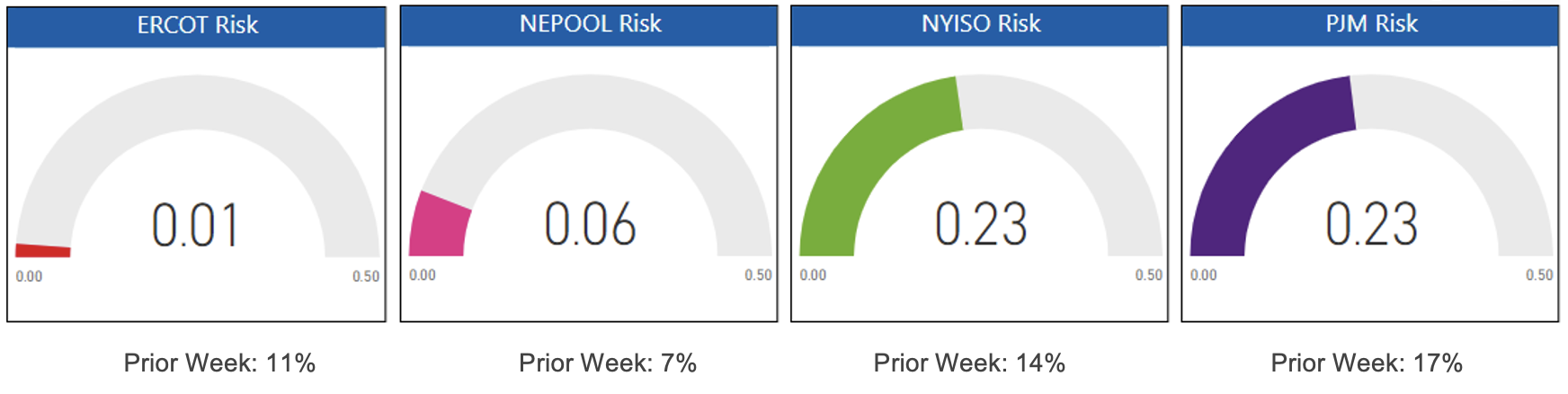

Last week was rare. Pricing requests for ERCOT were almost 100% focused on fixed-price solutions. This group of market participants is historically the most interested in some level of market-based risk. At the opposite end of the risk spectrum were NYISO and PJM, a rarity for these two. Their pricing requests showed week-over-week double-digit increases in pricing requests that included index or flex type products.

Risk Appetite Report 07/01/24 – 07/05/24

The risk appetite gauges above reflect the mix of fixed, flex, and index volume priced in the period for customers with peak demand above 750 KW.