Topsy Turvy

February 17, 2025

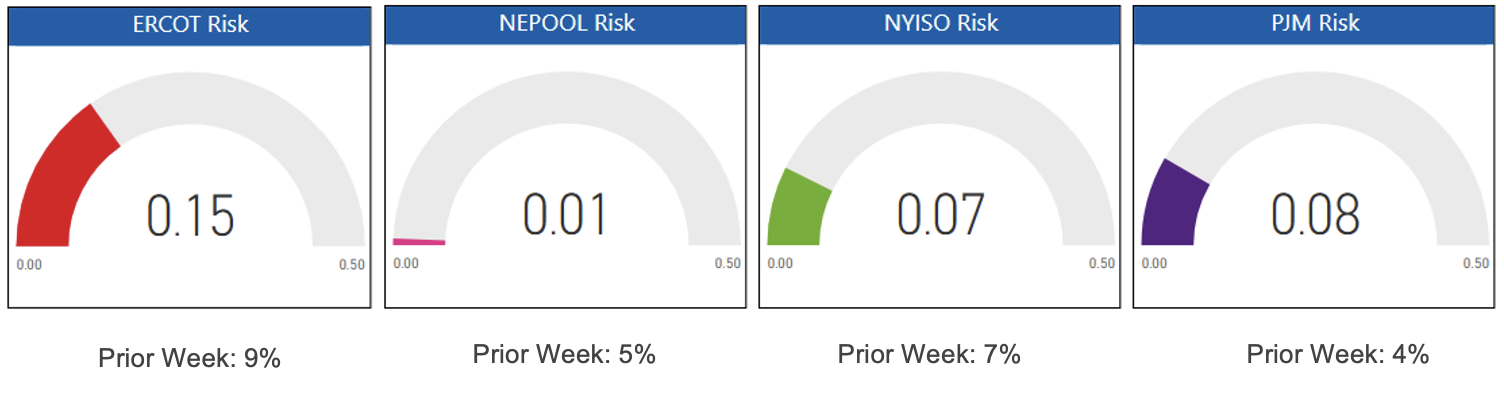

The volatility leaders returned to their old ways. Buyers and brokers in ERCOT returned to a double-digit ratio for market-based risk. Conversely, NEPOOL pricing requests showed a near zero interest in index or flex pricing. NYISO and PJM pricing participants tend to hold a steady interest in market-based risk, falling between the highs of ERCOT and the lows of NEPOOL.

Risk Appetite Report 02/10/25 – 02/14/25

The risk appetite gauges above reflect the mix of fixed, flex, and index volume priced in the period for customers with peak demand above 750 KW.