Risk Interest Remains High

June 10, 2024

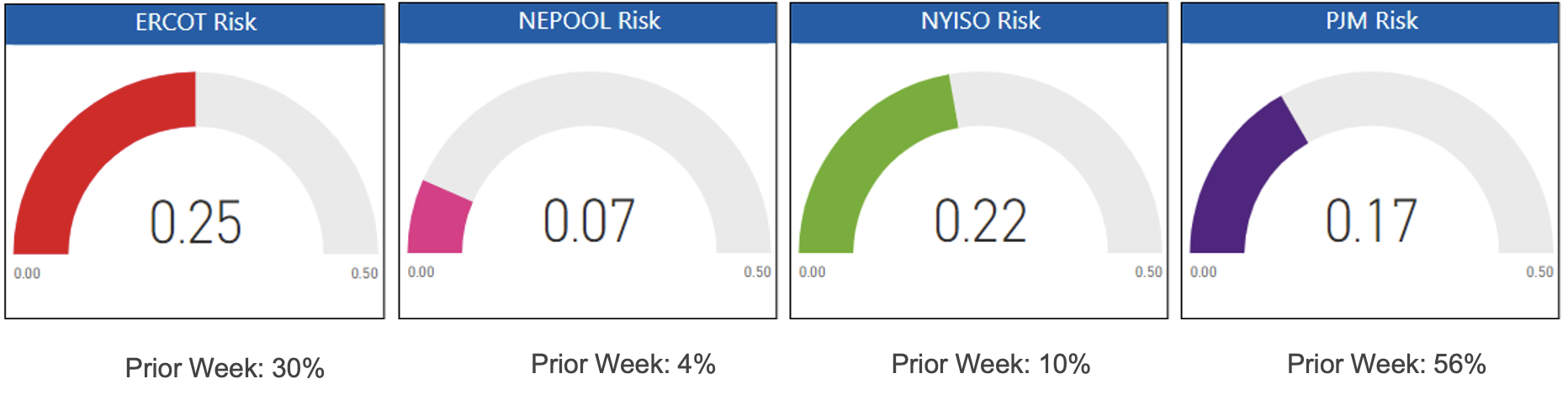

Buyers and brokers across the board are showing elevated interest in market-based risk. While PJM backed off considerably from the prior week’s 56% ratio, pricing requests in the region continue to include significantly higher levels of interest in index or flex solutions. NYISO market participants more than doubled their interest in market-based risk, and traditionally-conservative NEPOOL nearly doubled its preference for risk week-over-week. ERCOT, as always, demonstrates a strong ratio of pricing requests that include some risk.

Risk Appetite Report 6/3/24 – 6/7/24

The risk appetite gauges above reflect the mix of fixed, flex, and index volume priced in the period for customers with peak demand above 750 KW.