PJM Leads the Pack

January 03, 2025

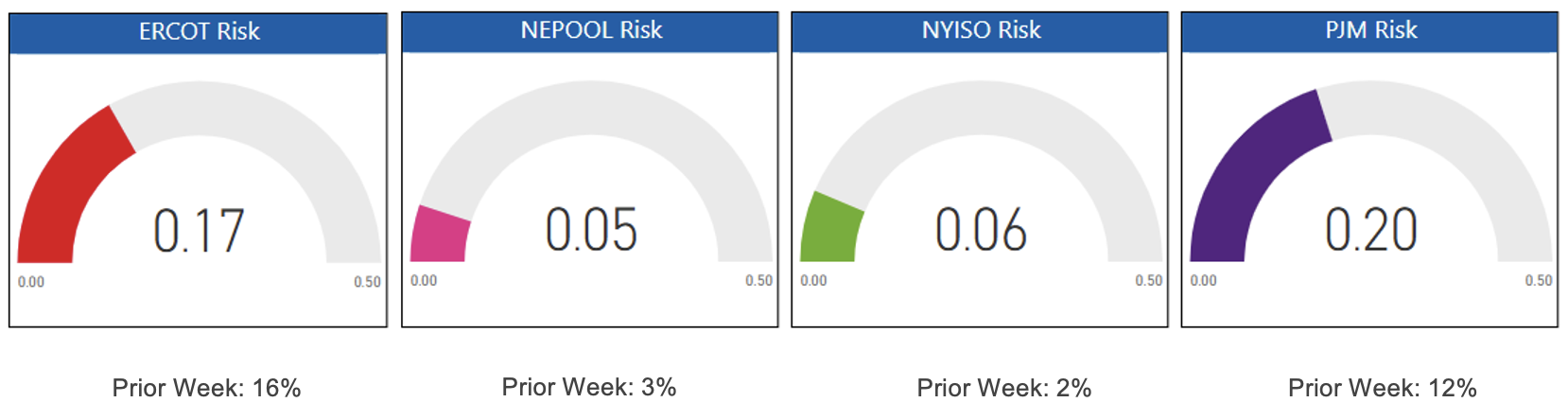

Buyers and brokers in PJM gave themselves the gift of more market-based risk last week. These market participants ended 2024 with 20% of their pricing requests focused on index or flex products. ERCOT was close behind at 17% while NEPOOL and NYISO took small steps in the risk-on direction.

Risk Appetite Report 12/30/24 – 01/03/25

The risk appetite gauges above reflect the mix of fixed, flex, and index volume priced in the period for customers with peak demand above 750 KW.