NYISO, ISO NE Bounce Back

October 07, 2024

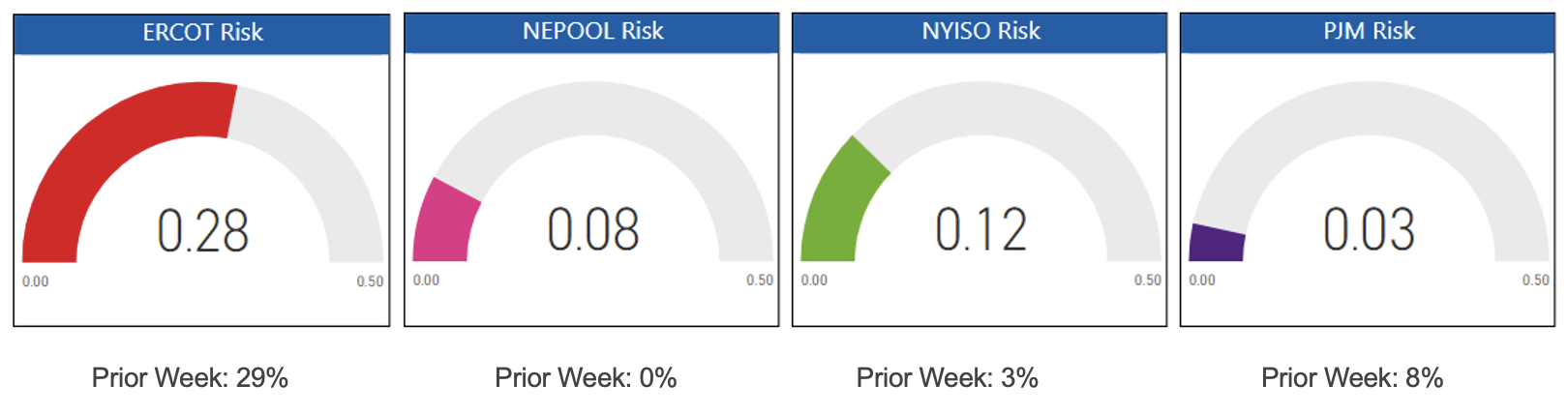

After a week of zero or near zero interest in market-based risk, participants in the northernmost regions bounced back with moderate appetites. ERCOT remains the most interested in index or flex products while PJM took a step back towards risk averse with a strong preference for pricing requests that feature fixed price solutions.

Risk Appetite Report 09/30/24 – 09/03/24

The risk appetite gauges above reflect the mix of fixed, flex, and index volume priced in the period for customers with peak demand above 750 KW.