No End to Trend

December 16, 2024

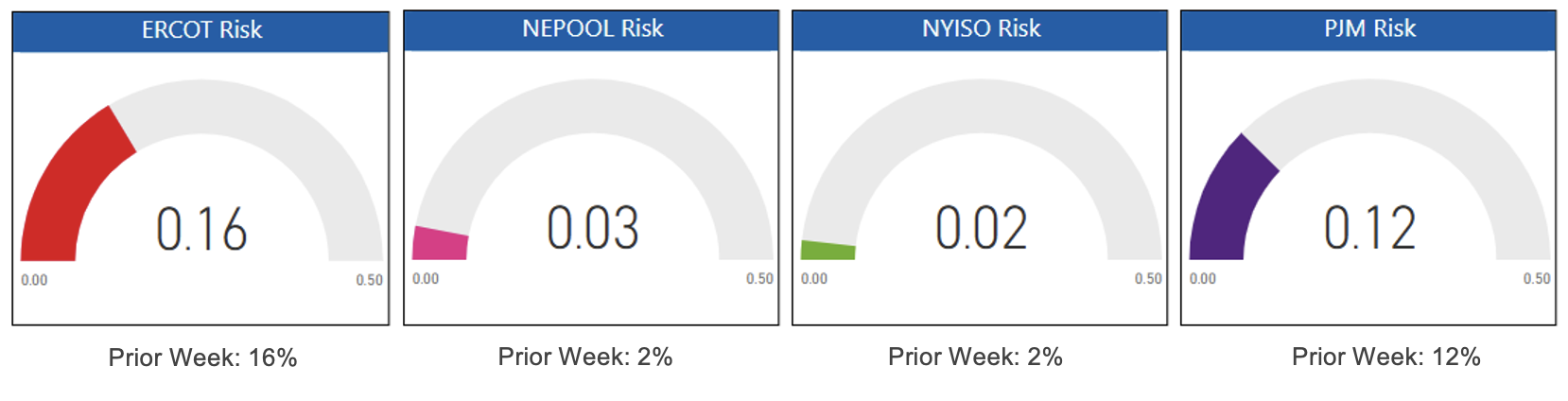

This week looks a lot like the previous one. The only change was a slight increase in market-based risk in pricing requests in ISO NE. The numbers one year ago were a bit different. ERCOT risk appetite was 6% and PJM was 25%. NYISO was 5% and ISO NE market participants were the most risk averse at 4%.

Risk Appetite Report 12/09/24 – 12/13/24

The risk appetite gauges above reflect the mix of fixed, flex, and index volume priced in the period for customers with peak demand above 750 KW.