NEPOOL Says No Thanks

January 13, 2025

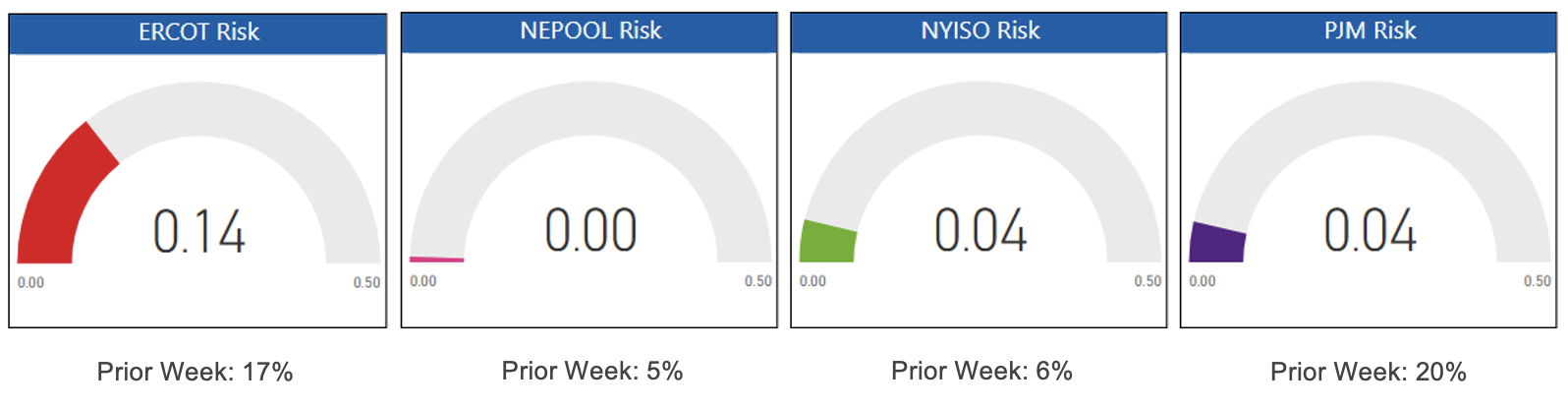

Two newsworthy observations this week. Buyers and brokers in PJM reversed course and dropped from a 20% interest in market-based risk, to only 4%. Market participants with NEPOOL pricing requests dropped from a 5% interest in index and/or flex products to absolutely no pricing requests with any market-based risk. It’s a rare occurrence, but NEPOOL has been flirting with zero for several weeks.

Risk Appetite Report 01/06/25 – 01/10/25

The risk appetite gauges above reflect the mix of fixed, flex, and index volume priced in the period for customers with peak demand above 750 KW.