Interest Cools

June 17, 2024

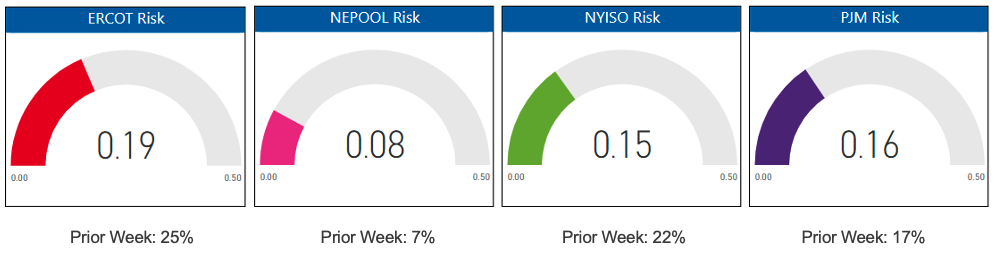

Buyers and brokers in three markets took a turn toward safety this week as they cut back on pricing requests with market-based risk. ERCOT, NYISO and PJM participants, however, still have double digit ratios of requests for index or flex products versus fixed price, but it is rare to see three markets with nearly the same profile. NEPOOL was the outlier with a slight increase in risk appetite.

Risk Appetite Report 6/10/24 – 6/14/24

The risk appetite gauges above reflect the mix of fixed, flex, and index volume priced in the period for customers with peak demand above 750 KW.