ERCOT Without Equal

October 14, 2024

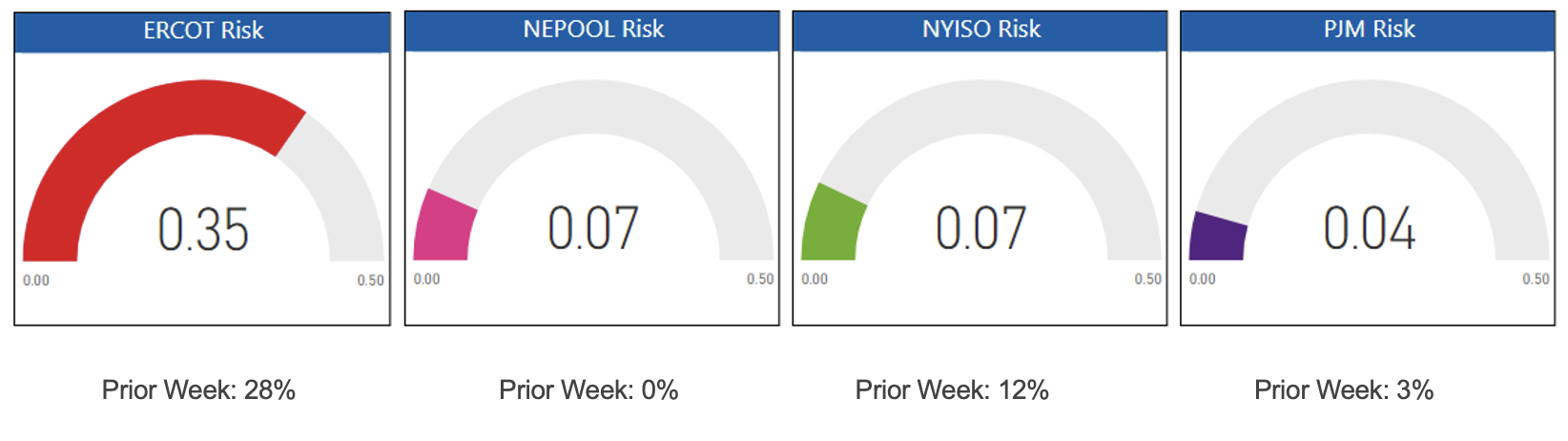

The long-running trend for ERCOT is back. This group of market participants has historically shown the greatest interest in pricing requests with some level of market-based risk. This week was another prime example with a 65:35 ratio of fixed to index or flex solutions.

ERCOT was not the only market to revert back to the mean. Interest in index or flex solutions was single digits for ISO NE, NYISO and PJM as all three were true to form.

Risk Appetite Report 10/06/24 – 10/10/24

The risk appetite gauges above reflect the mix of fixed, flex, and index volume priced in the period for customers with peak demand above 750 KW.